The Feasibility of Listing by Way of VIE Structures

Introduction

Certain sectors, industries or businesses in the People’s Republic of China (the “PRC”) are subject to foreign investment restrictions (“Restricted Business(es)”). Over the years, many listing applicants adopted variable interest entity (“VIE”) structures to enable the overseas listing of Restricted Businesses. This newsletter discusses the feasibility and the relevant regulatory framework for the listing of VIE structures in Hong Kong.

What is a VIE structure?

VIE structures have long been used by foreign parties to indirectly invest in sectors in the Restricted Business or have been adopted to enable Restricted Business to list offshore. Coined as a “Sina structure” after Sina.com successfully listed its value-added telecom business on NASDAQ in 2000 by adopting a VIE structure, VIE structures have been replicated in other sectors such as publications, broadcasting, media, mining and internet-based businesses.

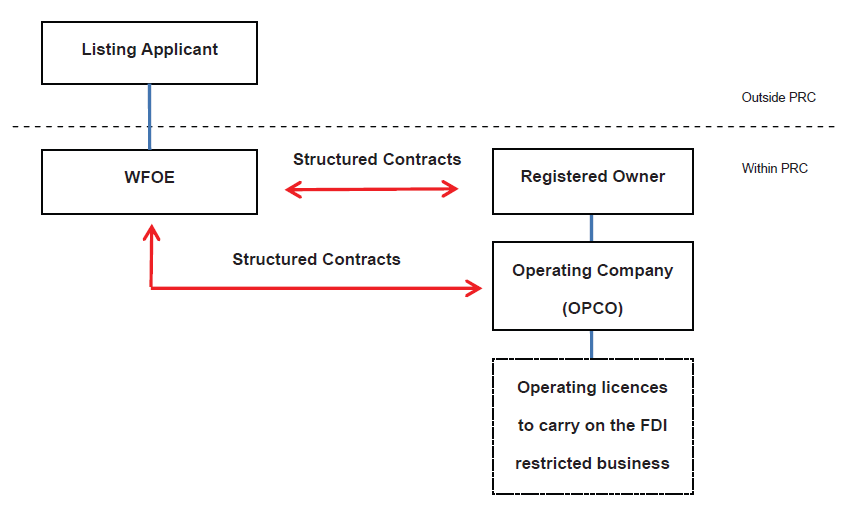

In essence, a VIE structure refers to a structure whereby a fully or partially foreign-owned entity established in the PRC has control over a PRC domestic enterprise which holds the necessary licence(s) to operate in a Restricted Business. By virtue of various contractual arrangements, the de facto control over the operation and management as well as the economic benefits of the PRC domestic enterprise are shifted to the foreign-owned entity. In past red chip listings adopting VIE structures, the “Regulations Concerning the Merger and Acquisition of Domestic Enterprises by Foreign Investors” (commonly known as “Circular 10”) was interpreted by the relevant issuers to be inapplicable as no acquisition of the relevant PRC domestic enterprises was involved.

Typical VIE/Structured Contract Arrangement

Can a VIE Structure be Listed in Hong Kong

Since there is no express endorsement of VIE structures by the PRC authorities, the legality of VIE structures is questionable. In 2010 and 2011, the Shanghai Sub-commission of the China International Economic and Trade Arbitration Commission (“CIETAC”) granted two arbitral awards, in which the CIETAC invalidated some VIE agreements on the grounds that they violated express provisions of PRC laws that prohibit foreign investors from controlling and participating in the Restricted Business and constituted “concealing illegal intentions with a lawful form”.[1] Further, in June 2013, the Supreme People’s Court ruled in a dispute involving Chinachem Financial Services Limited that the relevant entrustment agreements were void on similar grounds.[2] In light of these arbitral awards and judgment, there was an uncertainty as to whether VIE structures could continue to be listed in Hong Kong.

The uncertainty has now been lifted as different enterprises adopting VIE structures successfully listed in Hong Kong from 2012 to 2015.[3] The Stock Exchange of Hong Kong Limited (the “HKEx”) also published a listing decision to clarify that the listing of VIE structures would continue to be allowed on a case-by-case basis after full consideration of the reasons for adopting such arrangements, subject to certain requirements, including disclosure of the relevant details of the VIE structures and the risks involved in the prospectus.[4] The standard of review adopted by HKEx is summarised as follows:

Draft PRC Foreign Investment Law

Following the publication of the consultation draft of the new PRC Foreign Investment Law by the Ministry of Commerce in January 2015, concerns over the legality and validity of structured contracts to hold interests in PRC businesses which are subject to foreign ownership restrictions is heightened. Potential issuers who decide to press on with their listing plans ahead of the potential legislative change in the PRC, or use or intend to enter into transactions which involve the use of, structured contracts to hold interests in PRC businesses, should keep track of the regulatory development and seek competent legal advice. They are also encouraged to contact HKEx at the earliest possible opportunity to seek informal and confidential guidance.[14]

[1] “Shanghai CIETAC’s findings on VIE case raises plenty of questions”, China Business Law Journal, December 2012/January 2013 issue

[2] “Supreme court judgment again touches sensitive VIE nerve”, China Business Law Journal, July/August 2013 issue

[3] Recent examples include Feiyu Technology International Company Ltd. (Stock Code: 1022) and China Maple Leaf Educational Systems Limited (Stock Code: 1317) listed in 2014 and Zhongzhi Pharmaceutical Holdings Limited (Stock Code: 3737) and China Parenting Network Holdings Limited (Stock Code: 8361) listed in 2015.

[4] HKEx Listing Decision LD43-3

[5] Paragraph 13(b) of HKEx Listing Decision LD43-3

[6] Paragraph 13(c) of HKEx Listing Decision LD43-3

[7] Paragraph 13(d) of HKEx Listing Decision LD43-3

[8] Paragraph 18A of HKEx Listing Decision LD43-3

[9] Paragraph 16A of HKEx Listing Decision LD43-3

[10] Paragraph 18(c) of HKEx Listing Decision LD43-3

[11] Paragraph 19 of HKEx Listing Decision LD43-3

[12] Paragraph 20(b) of HKEx Listing Decision LD43-3

[13] Paragraph 18(b) of HKEx Listing Decision LD43-3

[14] Paragraph 22(b) of HKEx Listing Decision LD43-3

For enquiries, please feel free to contact us at: |

E: cc@onc.hk T: (852) 2810 1212 19th Floor, Three Exchange Square, 8 Connaught Place, Central, Hong Kong |

Important: The law and procedure on this subject are very specialised and complicated. This article is just a very general outline for reference and cannot be relied upon as legal advice in any individual case. If any advice or assistance is needed, please contact our solicitors. |